The Australian Government EV incentive means you don’t pay Fringe Benefits Tax (FBT) on eligible EVs, which could save you thousands in tax.

As one of Queensland’s largest novated lease providers, we can help get you into an electric car of your choice. We are working closely with key suppliers to help you make a confident choice – for yourself and the environment.

The New EV Discount: A Recap

Novated leases are required by law to have a certain amount of FBT be paid – it’s why pre- and post-tax payments are needed. With the Electric Car Discount however, a novated lease on an eligible EV is FBT exempt, meaning you don’t pay any post-tax contributions – for EVs retailing up to the Luxury Car Tax threshold of $91,387.

EV-Novated Lease Incentive Under Review

The government are conducting a review of the EV Discount. The review will run from 6 February6 February 2026 and due to reportby 2027, but a decision could be made to cease, alter, or continue it at any time during this timeframe.

We will monitor developments closely and advise you as soon as we know the outcome.

How Much Could You Save?

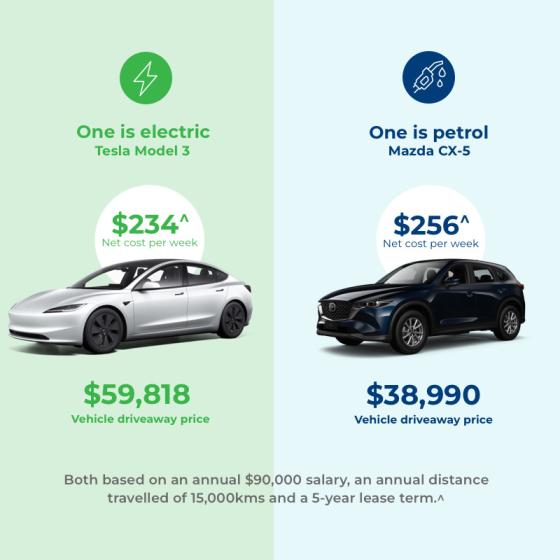

With the EV Discount and novated leasing, you could pay around the same amount for a new electric car as an equivalent petrol car – potentially saving you thousands of dollars.

In this example, the Tesla 3’s driveaway price is over $20,000 more than the Mazda CX-5, yet thanks to the potential tax savings of novated leasing, the cost per week is comparable – even less for the electric car!

EVs and Novated Leasing

Taking out a novated lease on an electric vehicle comes with many potential benefits, including:

A novated lease on an EV is fully FBT exempt – if its retail prices is below the Luxury Car Tax threshold of $91,387 – meaning all your payments are made from your pre-tax salary. This could reduce your taxable income – resulting in you potentially paying less tax than you would have otherwise.

Enjoy the budget convenience of having the car’s finance repayments and running costs – including electricity, registration, insurance and servicing – bundled into one regular pre-tax* payment across the course of the year.

In addition to the FBT exemption, the cost of running an EV could be less than a traditional petrol or diesel vehicle. The Electric Vehicle Council estimates that a city-based driver of a typical SUV, driving 15,000 kilometres per year, could save more than $135 per month on running costs.

Thinking about taking advantage of the Electric Car Discount? Think it’s time to talk to RemServ.

As Queensland’s largest novated leasing provider with more than 30 years’ experience, we know all there is to know about salary packaging a car. We’ve worked closely with key suppliers in the electric vehicle space and geared up our systems to help get you into an eco-friendly car of your choice.

Common Myths: Eco-Friendly Vehicles

We respond to five of the most common misconceptions about Electric Vehicles.

"They cost too much"

The upfront costs of electric vehicles are currently more expensive than conventional petrol vehicles, however things swing back in the other direction thereafter: powering an EV costs an estimated 70 per cent less per kilometre.

This is because EVs have lower running costs than regular cars: they have no engine, transmission, head gasket, filters or spark plugs.

"One charge doesn’t get you far"

Electric vehicle technology is constantly evolving. While the Electric Vehicle Council of Australia states that current EVs have an average battery range of nearly 480km, some newer models can get 550km on a single charge.

With the average Australian driving 38 kilometres a day, an EV owner who carries out a typical short trip each day could go for 10 or more days without needing to recharge, depending on their EV.

“It’s difficult to charge them”

Most new electric vehicles include an entry-level charger which simply connects to a typical electricity power outlet at home. Public charging solutions are also available across Australia. The Electric Vehicle Council of Australia website lists all available charging stations around Queensland and the rest of the country, including the types of chargers.

“Charging takes too long”

While entry-level chargers supplied with electric vehicles can take up to 30 hours to fully charge a vehicle, there are other options that reduce this timeframe. You can purchase higher capacity chargers available at an optional cost which can get the job done much more quickly.

Public chargers also can be much faster – with super-charge stations potentially adding up to 300 kilometres of range in 10 to 15 minutes, and regular charging stations often doing the job in less than five hours.

“They lack power”

Electric vehicles have the capacity to deliver full torque instantly, allowing them to accelerate faster than regular vehicles.

They can also provide better handling and cornering due to the gravity-lowering placement of their batteries at the bottom of the vehicle.

Got more questions about salary packaging an eco-friendly car? We've got you covered.

*Novated Lease example: The estimated potential tax benefit is over the full-term of the lease, is exclusive of GST and is based on the assumption that you would salary package using Employee Contribution Method (ECM) or Fringe Benefits Tax Exempt Method. The Fringe Benefits Tax Exempt Method is only used for eligible electric vehicles under the luxury car tax threshold of $91,387. Payment includes: Your car payments, fuel or charging, registration, tyres, insurance, scheduled servicing, fleet management fee and are exclusive of GST. The estimated annual benefit will vary depending upon salary, employment circumstances, selected benefits and applicable tax treatment. The example assumes you earn $90,000 a year, a 5-year lease term, an annual distance travelled of 15,000kms and a 28.13% residual value. GST of 1/11th is payable on your ECM contributions. State Stamp Duty rates apply. PAYG tax rates effective 1 July 2024 have been used.

Things you need to know: This general information doesn’t take your personal circumstances into account. Please consider whether this information is right for you before making a decision and seek professional independent tax or financial advice. Conditions and fees apply. The availability of benefits is subject to your employer’s approval. RemServ may receive commissions in connection with its services. From 1 April 2025, a plug-in hybrid electric vehicle is no longer considered a zero or low emissions vehicle under FBT law. However, your employer can continue to apply the exemption if both the following requirements are met: 1) Use of the plug-in hybrid electric vehicle was exempt before 1 April 2025. 2) You have a financially binding commitment to continue using the vehicle for private use on and after 1 April 2025. For this purpose, any optional extension of the agreement is not considered binding. To qualify for the EV discount, plug-in hybrid electric vehicles must have been delivered by midnight on 31 March 2025. Due to high demand and stock limitations there may be some vehicles that do not meet the delivery deadline for the EV Discount. Customers are advised to confirm delivery timelines before proceeding with their order.

Remuneration Services (Qld) Pty Ltd | ABN 46 093 173 089.

Keen to find out more about a RemServ Novated Lease?

Whether you’re ready to get started or need more information, we’re here to help.