As one of Queensland’s largest novated lease providers, we’re ready to help get you into a car of your choice. We’ve geared up our systems and are working closely with key suppliers to help you make a confident choice – for yourself and the environment.

WHAT ARE THE BENEFITS?

Why lease a car with RemServ

We can help source your new car, have it delivered to your home or work, manage all the paperwork and even arrange the finance and insurance – leaving you to enjoy that new-car feeling!

We’ll tap into our nationwide preferred dealer network to get you a great deal on a great car. Plus, you can save on GST through a novated lease.

With a novated lease, part of your payments come from your pre-tax salary. This could reduce your taxable income and boost your take-home pay.

We’ll draw up a comprehensive, adjustable budget that bundles your finance repayments and running costs – including fuel, registration, insurance and servicing – into one regular, easy-to-manage payment.

Novated Leasing

A tax-effective way to salary package your next car

You may have overheard work colleagues talk up novated leasing, but apart from “that thing where you could save on a car”, what is it – and how does it work?

Basically, a new, used or existing car is leased in your name, via your employer, but unlike regular car finance, your repayments are sourced from a combination of your pre and post-tax salary. While fringe benefits tax might apply, salary packaging a car could lower your taxable income and reduce the overall cost of running a car.

Thinking about an electric vehicle?

With the Australian Government’s Electric Car (EV) Discount, taking out a novated lease on an EV just got a whole lot cheaper. Novated leases are required by law to have a certain amount of Fringe Benefits Tax be paid – it’s why pre- and post-tax payments are needed. With the Electric Car Discount however, a novated lease on an eligible EV is FBT exempt, meaning you don’t pay any post-tax contributions – for EVs retailing up to the Luxury Car Tax threshold of $91,387#.

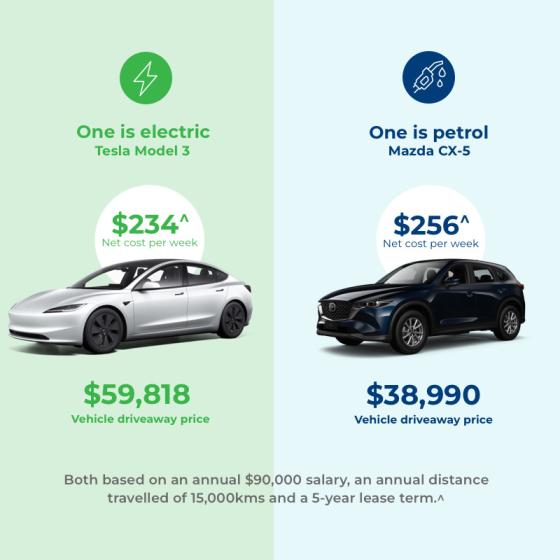

How Much Could You Save on an EV Novated Lease?

We’ve compared the potential savings you could get under existing novated lease policy with what you could enjoy under the EV Discount. Let’s say you earn $90,000, and you’ve decided an Tesla 3 is for you, driving it 15,000 kilometres a year over a five-year lease.

Your estimated net benefit under the EV Discount is $43,148^.

Keen to find out more about a RemServ Novated Lease?

Whether you’re ready to get started or need more information, we’re here to help.

*All eligible vehicles must be ordered before 30/06/2025 (unless extended), or while stocks last. Displayed price is only available through a novated lease administered by RemServ. Weekly costs have been determined based on the following assumptions: 1) The lease is a RemServ fully maintained lease, 2) a 5 year term, 3) a residual value of 28.13% of the vehicle purchase price payable at the end of term, 4) Inclusion of finance and budgeted costs for: fuel or electricity, 8 replacement tyres, maintenance, roadside assistance, registration, CTP and comprehensive insurance, 5) Gross annual salary is $90,000 6) Vehicle purchased in QLD, 7) 15,000km per annum, 8) Salary Sacrifice using Employee Contribution Method (ECM) or Fringe Benefits Tax Exempt Method. The Fringe Benefits Tax Exempt Method is only used for eligible electric vehicles under the luxury car tax threshold of $91,387. The indicative price quoted for the novated lease is based on vehicle quotations RemServ has received within the last 45 days and does not include any optional extras. Any optional extras that you choose will affect the cost of the novated lease and residual value. If you purchase the vehicle on termination of the novated lease, GST will apply on the purchase price you pay at that time. The novated lease offer is based on the assumption outlined above, and is an indicative cost approximation of the selected vehicle and model shown and the amounts may change at the time the novated lease quotation is completed and finalised. Your individual circumstances have not been taken into account as this will affect the overall weekly cost amount and the benefits of a novated lease. These specials cannot be used in conjunction with any other offer.

From 1 April 2025, a plug-in hybrid electric vehicle is no longer considered a zero or low emissions vehicle under FBT law. However, your employer can continue to apply the exemption if both the following requirements are met: 1) Use of the plug-in hybrid electric vehicle was exempt before 1 April 2025. 2) You have a financially binding commitment to continue using the vehicle for private use on and after 1 April 2025. For this purpose, any optional extension of the agreement is not considered binding. To qualify for the EV discount, plug-in hybrid electric vehicles must have been delivered by midnight on 31 March 2025.

#For the 2024/25 financial year.

^Savings shown are indicative and reflect estimated tax savings over the full-term of the lease. The total amount saved is a comparison between a novated lease based on the assumption outlined above and the purchase of a vehicle and payment of running and maintenance costs using post-tax earnings. Actual savings will depend on your personal circumstances.

^Novated Lease example: The estimated potential tax benefit is over the full-term of the lease, is exclusive of GST and is based on the assumption that you would salary package using Employee Contribution Method (ECM) or Fringe Benefits Tax Exempt Method. The Fringe Benefits Tax Exempt Method is only used for eligible electric vehicles under the luxury car tax threshold of $91,387. Payment includes: Your car payments, fuel or charging, registration, tyres, insurance, scheduled servicing, fleet management fee and are exclusive of GST. The estimated annual benefit will vary depending upon salary, employment circumstances, selected benefits and applicable tax treatment. The example assumes you earn $90,000 a year, a 5-year lease term, an annual distance travelled of 15,000kms and a 28.13% residual value. GST of 1/11th is payable on your ECM contributions. State Stamp Duty rates apply. PAYG tax rates effective 1 July 2024 have been used.

Things you need to know: This general information doesn’t take your personal circumstances into account. Please consider whether this information is right for you before making a decision and seek professional independent tax or financial advice. Conditions and fees apply. The availability of benefits is subject to your employer’s approval. RemServ may receive commissions in connection with its services.

Remuneration Services (Qld) Pty Ltd | ABN 46 093 173 089.